How Does Car Insurance Work in Malaysia

The price of your premium will first depend on the type of coverage you choose. Is car insurance mandatory in Malaysia.

Best Car Insurance In Malaysia 2022 Compare And Buy Online

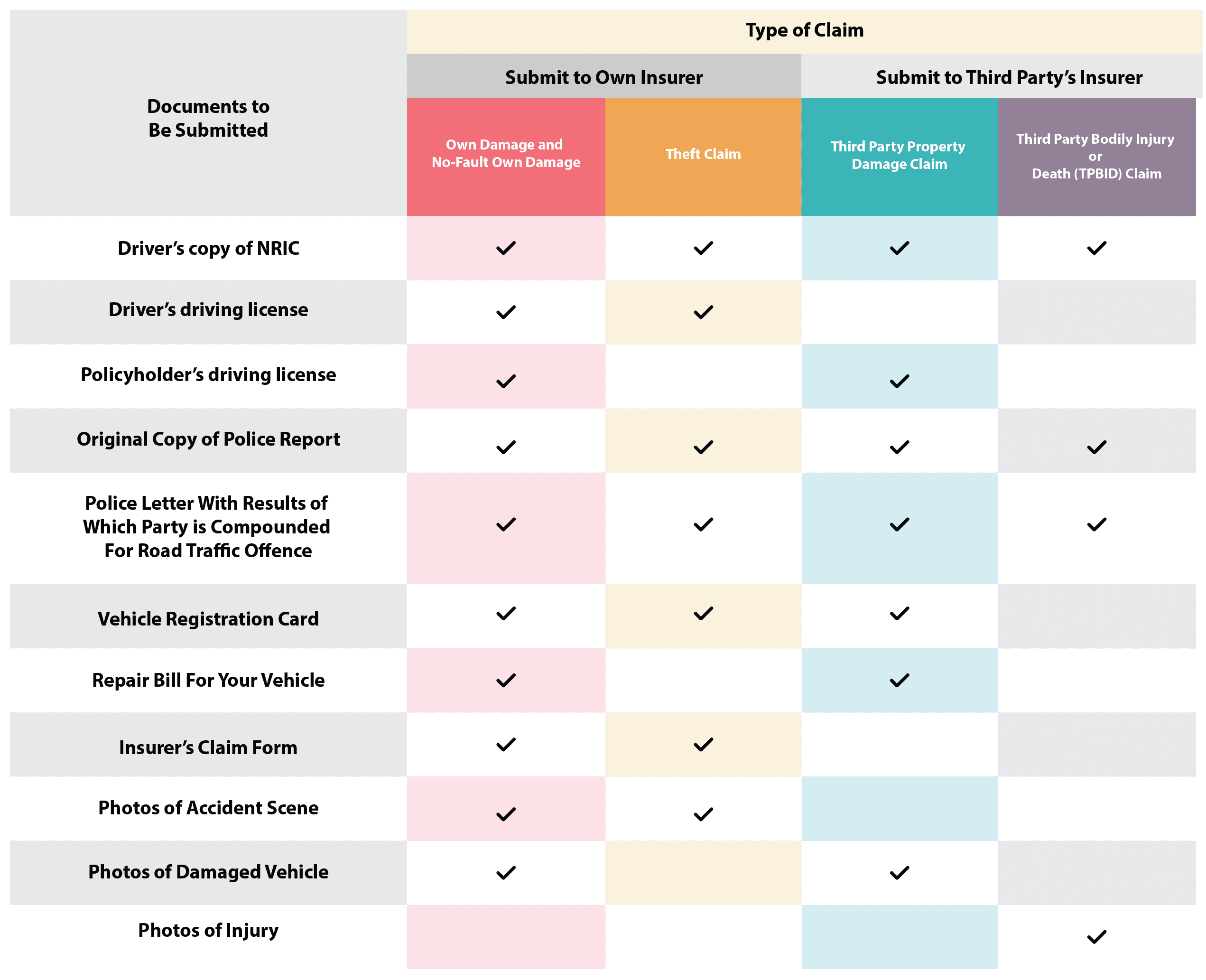

In the event of an accident it is necessary to file a police report detailing the accident within 24 hours and inform the vehicles insurance company to make a claim.

. Generally for each year that you drive without making a claim you earn a 10 discount when you renew your insurance policy - up to a cap of 50. However note the additional premium you have to pay for CART varies across insurers. Second party the insurance company.

Whenever you pay your premium to a car insurance. Personal accident as low as RM15year for driver and passengers. How does car insurance work.

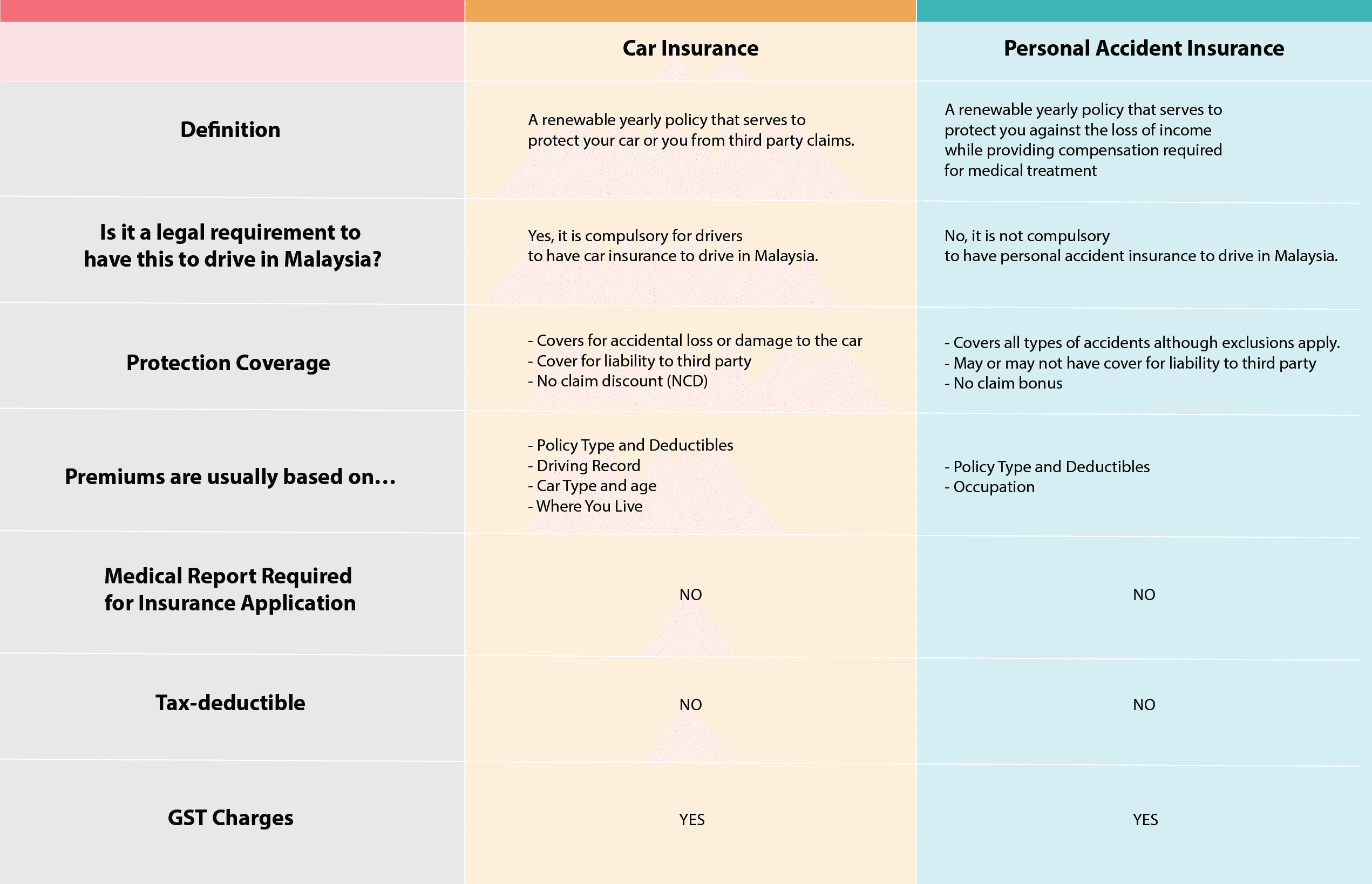

Unlimited use of courtesy car. Car insurance is a form of security provided by the insurance company to the owner or driver of a vehicle against any possible claims for damages andor losses caused by the vehicle while being used on the road. Your insurance company will manage the funds and use them to cover the financial losses involving the.

It helps to research and ask for reviews from family and friends before choosing one. Apply for a car insurance on RinggitPlus for exclusive gifts. Basically car insurance protects you against the losses or damages of your vehicle or the third partys vehicle due to accidents fire or theft depending on the policy selected.

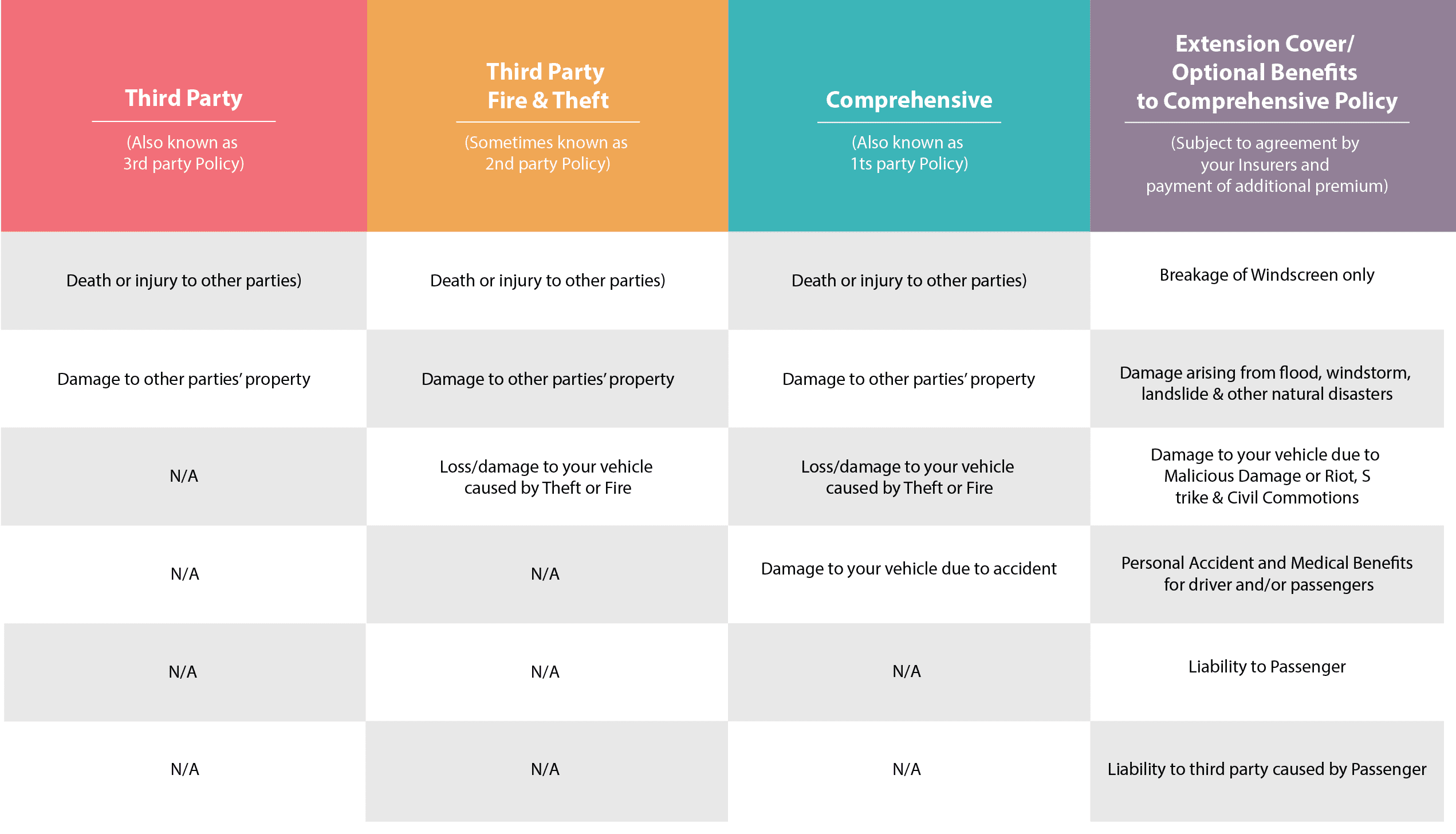

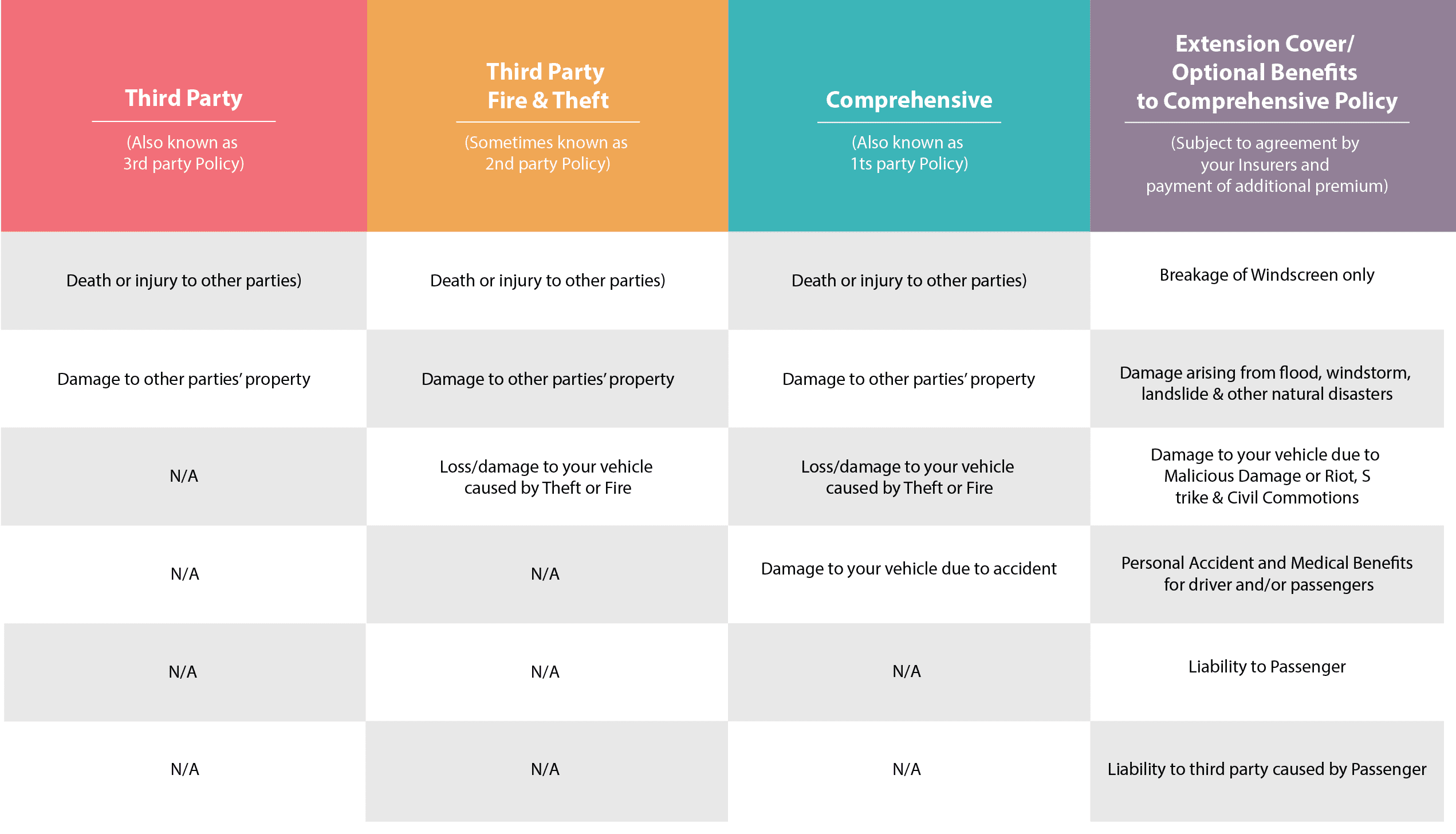

Third-party fire and theft coverage. Purchase additional CART coverage. The basic structure of a car insurance model works like this.

If youre confused over these wordings heres a quick overview of how insurance companies term them. The website Autoworld Malaysia has an insurance premium calculator. Written by iMoney Editorial.

However its always advisable to purchase a comprehensive insurance plan which offers. Each private car insurance policy in Malaysia allows. Coverage on Accessories Fixed to Your Vehicle.

In simplest terms you are the policyholder and the insurance company that you decide to go with is the insurer. Having this insurance coverage allows car owners to be protected from having to pay the damages of another car in the event of an accident. To be protected and covered for damage to your own vehicle.

Up to 10 discount on premium for low-risk drivers. Water damage cover as low as RM10 per year. 10 minutes claims approval.

Car insurance in Malaysia is necessary to protect yourself and other drivers who you may inadvertently injure. Dataran Maybank No 1 Jalan Maarof Bangsar 59000 Kuala Lumpur Wilayah Persekutuan Kuala Lumpur Malaysia. If you need some extra guide on how to choose the right car insurance coverage we recommend you checking out this piece we recently did.

It is one of the most basic types of car insurance bought by the car owners as it is mandatory to have this type of car. You will be able to make a claim for compensation for his or her injuries as well as any physical damage done to their vehicle if you have car insurance third-party cover. This means after 5 years of no claims you.

Therefore you may want to consider purchasing CART coverage in your comprehensive plan policy. In a nutshell yes. On the other hand personal accident insurance is not a compulsory cover.

It is an offence under the laws of the Republic of Singapore to enter the country without extending passenger liability cover to ones motor insurance. Third party fire and theft aka. Before the insurance news about phased liberalisation came out auto insurance was standardised with same coverage and price details.

You also want to ensure the company you choose is reputable and has a good customer service record. You want to make sure you get the best coverage for your needs. First party you the driver.

The policyholder is required to pay the insurer an arrangement amount at regular intervals monthly or in a lump sum. No-Claim Discount NCD A No-Claim Discount or NCD is a discount on your car insurance premium which you can earn for consecutive years of safe driving. All insurance Buy online Comprehensive 3rd party Fire theft 3rd party e-Hailing.

At the bare minimum third party car insurance is compulsory for all drivers and if youre a car owner youll need to purchase motor insurance before youre able to renew your road tax. So if the vehicle is insured for RM70000 this will only set you back by RM350. Compare car insurance quotes and plans with flexible coverage of loss and damage due to accident fire and theft.

There are three main types of car insurance in Malaysia. Adding to our life insurance series we will now take a look at how life insurance works in Malaysia. Heres a look at the three types of car insurance available.

The premiums that you and other policyholders pay will go to the insurers funds. This additional cover compensates you in the event of injury disability or death due to. This is the most basic and common car insurance bought by car owners as it is mandatory to have this type of car insurance for every vehicle.

Third party everyone else. When making a claim the following details should be given to the insurance company. In Malaysia you get to choose from either third party third party fire and theft and comprehensive cover.

Apply for a car insurance on RinggitPlus for exclusive gifts. CART is beneficial where you may use the compensation to cover the cost of car rental or taxi fares while your car is in repair. Up to 20 discount with voluntary excess.

Second party and comprehensive. You can easily get a quotation for the prices on their website. Top-rated insurance company Etiqa offers car insurance online in Malaysia.

In order for you to enjoy the protection by your insurance you will need to pay an amount or premium to your selected insurer annually. With more than 30 car insurers nationwide you must choose your insurer wisely. The cost of this special perils coverage add-on varies according to insurance providers but it generally only costs around 05 percent of the total vehicle premium.

Car Insurance Premium Calculation Ncd Rate In Malaysia

How To Choose The Right Type Of Motor Insurance For Your Needs

Best Car Insurance In Malaysia 2022 Compare And Buy Online

Everything About Car Insurance In Malaysia From Special Perils Coverage To Premiums

No Claim Discount Ncd The Complete Guide For Malaysia Car Owners

Best Car Insurance In Malaysia 2022 Compare And Buy Online

0 Response to "How Does Car Insurance Work in Malaysia"

Post a Comment